NH PA-28 2023-2025 free printable template

Show details

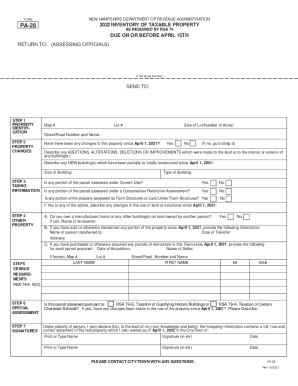

FORMNEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATIONPA282023 INVENTORY OF TAXABLE PROPERTY AS REQUIRED BY RSA 74DUE ON OR BEFORE APRIL 15TH RETURN TO: (ASSESSING OFFICIALS)(Fold along this line)SEND

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa 28 form inventory revenue administration printable

Edit your nh pa28 form inventory property department fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa 28 form inventory department revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new hampshire 28 inventory property revenue template online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pa28 inventory taxable department revenue pdf form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NH PA-28 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nh pa28 inventory property administration fillable form

How to fill out NH PA-28

01

Obtain a copy of the NH PA-28 form from the New Hampshire Department of Revenue Administration website or local office.

02

Fill in the taxpayer's information, including name, address, and tax identification number at the top of the form.

03

Specify the type of property for which the PA-28 is being filed (such as real estate or personal property).

04

Provide a detailed description of the property, including the location and any relevant identification numbers.

05

Indicate the date of the property transfer or acquisition.

06

Include the purchase price or fair market value of the property.

07

Sign and date the form to certify the information is correct before submitting it.

08

Submit the completed form to the appropriate municipal office by the specified deadline.

Who needs NH PA-28?

01

Individuals or businesses that are transferring property ownership in New Hampshire.

02

Property owners who need to report changes in ownership for tax assessment purposes.

03

Heirs or estate representatives filing a property transfer upon the death of an owner.

Fill

new hampshire inventory taxable form

: Try Risk Free

People Also Ask about pa 28 inventory department revenue printable

Do I have to pay taxes on rental income in NH?

Yes. Numerous short-term rental hosts in New Hampshire file several state and local lodging tax returns every year.

What is enterprise value tax base?

The tax is assessed on taxable enterprise value tax base, which is the sum of all compensation paid or accrued, interest paid or accrued, and dividends paid by the business enterprise at the rate of .

What is the land use change tax in NH?

When land is taken out of current use a one time 10% land use change tax (LUCT) is assessed based on the market value of the land in question at the time the use changes to non-qualifying. This may or may not be the selling price.

What is the rental income tax in New Hampshire?

Please note that effective October 1, 2021 the Meals & Rentals Tax rate is reduced from 9% to 8.5%. Note: Motor vehicle fees, other than the Motor Vehicle Rental Tax, are administered by the NH Department of Safety.

Does NH have property tax?

New Hampshire residents don't pay any personal income or sales taxes, which gives the state quite a positive look. However, it makes up for it with its property taxes, as it boasts the fourth-highest property tax rate in the U.S. at 1.77%.

What is the renters tax in NH?

Payments are made quarterly. Unlike the BPT and BET, the rooms and meals tax applies to the first dollar of rent. It is assessed at a rate of 9 percent of gross rent collected, and on a monthly basis the payment and a tax return must be submitted to the state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new hampshire pa inventory taxable revenue download in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your new hampshire pa28 form department as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute new hampshire pa 28 inventory department administration online?

pdfFiller has made filling out and eSigning nh pa inventory easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out the 28 inventory taxable property department download form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign new hampshire pa 28 taxable revenue fill and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NH PA-28?

NH PA-28 is a form used in New Hampshire for reporting the estate tax return for decedents who passed away on or after January 1, 2009.

Who is required to file NH PA-28?

Any executor or administrator of a decedent's estate whose gross estate exceeds the filing threshold set by the New Hampshire Department of Revenue Administration is required to file NH PA-28.

How to fill out NH PA-28?

To fill out NH PA-28, you need to provide information about the decedent's estate, the total value of assets, liabilities, deductions, and any applicable credits. It is advisable to refer to the official instructions and guidelines provided by the New Hampshire Department of Revenue Administration.

What is the purpose of NH PA-28?

The purpose of NH PA-28 is to calculate and report the estate tax due on the estate of the decedent and ensure compliance with state tax regulations.

What information must be reported on NH PA-28?

NH PA-28 requires reporting of the decedent's name, date of death, marital status, total value of the gross estate, deductions, liabilities, and any applicable tax credits or payments made.

Fill out your NH PA-28 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Hampshire Pa Inventory Revenue Online is not the form you're looking for?Search for another form here.

Keywords relevant to nh pa 28 form inventory property revenue printable

Related to nh pa28 department revenue print

If you believe that this page should be taken down, please follow our DMCA take down process

here

.